What is Blockchain Banking?

Credit Unions are non-profit organizations that are owned by the members and they are insured up to $250,000. Members are paid first not the shareholders!

Interest Rate Risk (IRR) What is it?

Interest rate risk refers to the current and prospective risk to a credit union’s capital and earnings arising from movements in interest rates

Blockchain Banking and the American Credit Union Movement – Part 1

Since the Federal Credit Union Act of The following summarizes the historical background to the U.S. Credit Union Movement and how that history is a preview to new and powerful savings and earning opportunities afforded by blockchain technology. History is an important teacher: To understand where we are going, it is important to understand where we came from.

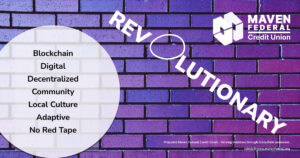

Maven Federal Credit Union is more than just about saving and spending money.

Maven will be adaptive. Members can tailor the credit union for their community’s specific needs. And with a digital credit union, you can still do all the same banking tasks you’re used to; deposit, withdrawal, and getting loans but WITHOUT THE RED TAPE. You can deposit & withdraw, and convert, both dollars and digital assets like Bitcoin and NFT’s. And all deposits will be federally insured.